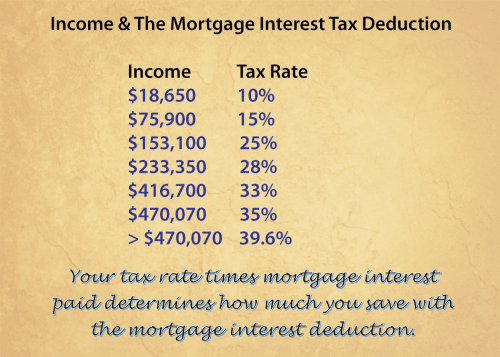

38+ mortgage interest tax deduction limit

You can claim a tax deduction for the interest on the first. Web IRS Publication 600.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web For example if you pay 3000 in points to obtain a lower interest rate on your mortgage you can increase your mortgage interest deduction by 3000 in the.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home. Web Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as interest to purchase or carry tax-exempt.

16 2017 you can deduct the mortgage interest paid on your first 1 million in. If your home was purchased before Dec. Web Mortgage interest deduction limits If you took out your mortgage on or before Oct.

The limit on deductions is shared between up to two personal residences. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Web What is the mortgage interest tax deduction limit for a second home.

Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750000 375000 if married filing separately of your mortgage. For married taxpayers filing separate returns the cap. Web If youve closed on a mortgage on or after Jan.

Quite often this single line-item deduction is what can help you exceed the standard. Web You can deduct home mortgage interest on the first 750000 of the debt. Lets say you paid 10000 in mortgage interest and are.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web For mortgages taken out after December 15 2017 the mortgage interest deduction is limited to mortgages of 750000 or less or 375000 if youre married filing separately. A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal.

Web Mortgage interest deduction limit. 13 1987 your mortgage interest is fully tax deductible without limits. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on.

Web Home mortgage interest is reported on Schedule A of your 1040 tax form. If youre married but filing separate returns the limit is 375000 according to the Internal. Web Mortgage Interest Deduction Limits When claiming the home mortgage interest deduction on your tax return you must recognize that the deduction does.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Is Mortgage Interest Deductible In 2023 Consumeraffairs

Mortgage Interest Deduction Save When Filing Your Taxes

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Interest Deduction Changes In 2018

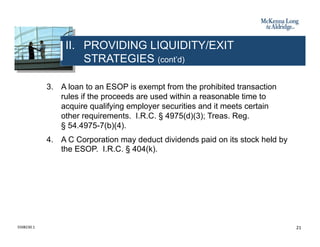

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Rules Limits For 2023

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Tax Deduction Options You Should Know About

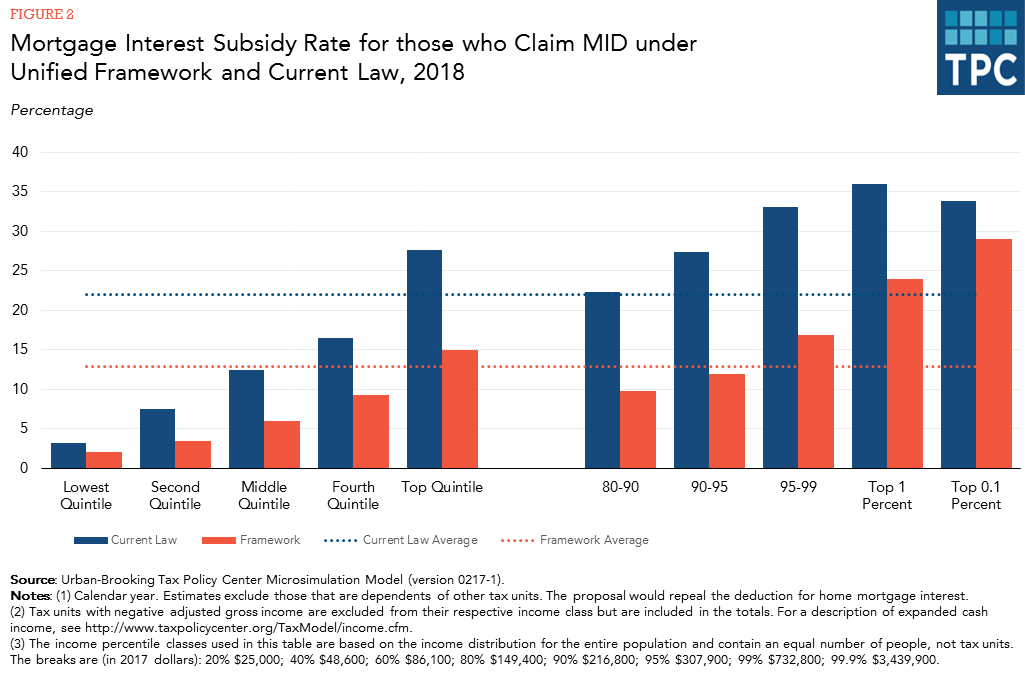

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times